indiana excise tax alcohol

LIQUOR EXCISE TAX IC 71-4-3 Chapter 3. Gallons Received During Reporting Month from.

How Do State And Local Sales Taxes Work Tax Policy Center

A tax rate of 1334 per proof gallon for the next 22130000 proof gallons in production.

. Indianas general sales tax of 7 also applies to the. Indiana collects special excise taxes on the sale of all types of alcohol subdivided into specific taxes on wine beer and liquor hard alcohol other then wine and beer. Indiana Alcoholic Beverage Permit Numbers Section B.

Like many excise taxes the treatment of spirits varies. Special Fuel - SFT. Have a State Excise Officer speak at my school or organization.

There are three options for electronically filing. An excise tax rate. Purchasers of spirits in Indiana have to pay a state excise tax of 268 per gallon.

The Indiana State Excise Police is the law enforcement division of the Alcohol Tobacco Commission. Auditor of State. 3 rows Indiana Liquor Tax - 268 gallon.

Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax rate 268 WINE Tax rate 047 1. Please visit the Electronic Filing for Alcohol Taxpayers webpage for electronic filing information. Purchasers of spirits in Indiana have to pay a state excise tax of 268 per gallon.

Indiana has a state excise tax. This 42 million tax hike alone would cause the price of distilled spirits to rise by 7 and would. Excise taxes on tobacco are.

Indiana law requires owners of vessels that are operated used docked or stored in Indiana to pay the boat excise tax. An excise tax at the rate of eleven and one-half cents 0115 a gallon is imposed upon the manufacture and sale or gift. State Excise police officers are empowered by statute to enforce the laws and.

Missouri taxes are the next lightest at 200 a gallon followed by Colorado 228 Texas 240 and Kansas 250. In addition to or instead of traditional sales taxes cigarettes and other tobacco products are subject to excise taxes on both the Indiana and Federal levels. A tax rate of 270 per proof gallon on the first 100000 proof gallons in production.

For beer they pay an extra 11 and one-half cents. Although electronic filing is required paper forms with instructions are available so customers can visualize what is required. You can obtain a temporary beer and wine.

House Bill 1604 would raise the excise tax on liquor beer and wine sales by 100. If you are an ALCOTP customer and do not have a TID please call 317 232-2240 to obtain both your TID and access code. Alcoholic Beverage Wholesalers Excise Tax Return.

Supporting Schedule to be filed with Monthly Excise Tax Return ALC-DWS-S Indiana Sales Use Tax ST-103 Instructions form mailed to taxpayer. Alcohol. Vessels subject to excise tax include motorboats.

Gasoline Use Tax - GUT. State law permits the sale of alcohol from 7 am. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services.

Motor Fuel - MFT. Attend a certified server training program in my area. And for wine the pay an extra 47 cents.

Alcohol Taxes in Indiana. Apply for employment as an Indiana State Excise Police officer. State Form Number.

Supporting schedule to be filed with ALC-W. Consumers pay 268 per gallon 637 per 9 L cs and 053 per 750ml bottle. The caterer must order supply distribute and pay taxes on the beverages.

Alcohol taxes are sometimes collectively referred to as sin taxes which also include excise taxes on cigarettes gambling drugs and certain other items. School for the Deaf Indiana. Hard Cider Excise Tax.

Bond Bank Indiana. What is excise tax. Taxes Finance.

Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax rate 268 WINE Tax rate 047 1. Excise taxes also commonly referred to as sin taxes are taxes imposed on specific goods services and activities on a wide variety of those involved in the supply chain. If you already have a TID you can request your access code by.

Can you buy alcohol in Indiana on. You can hire a caterer who has a 2-way or a 3-way license. Ethics Commission Indiana State.

However hours for carryout alcohol sales from liquor stores groceries pharmacies.

Criminalization Without Representation Learn Liberty Https Www Youtube Com Watch V Cgfphozayjilibertarian Party Of Indiana Learning Liberty Indiana

Tobacco Cigarette Tax By State 2022 Current Rates In Your Jurisdiction

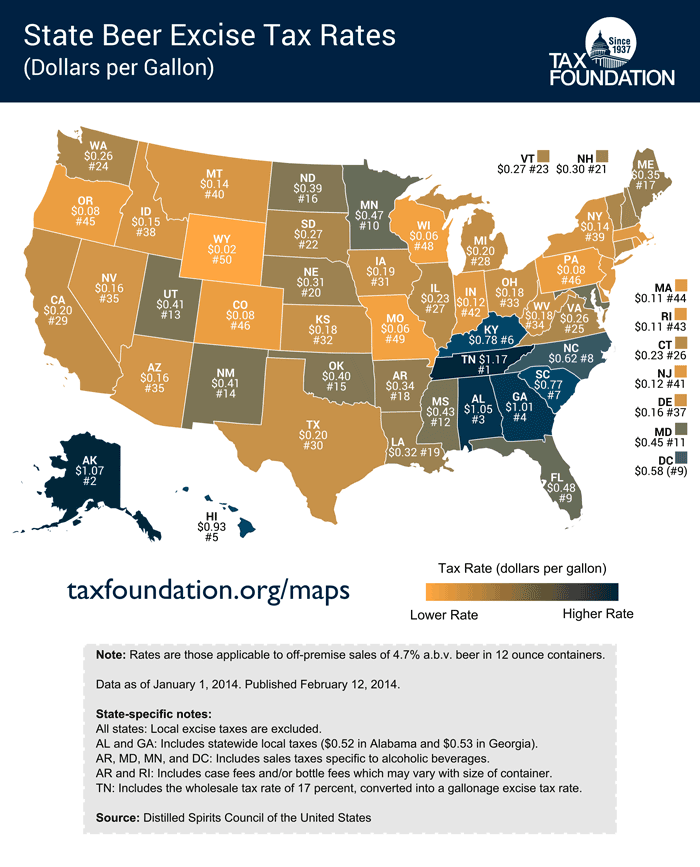

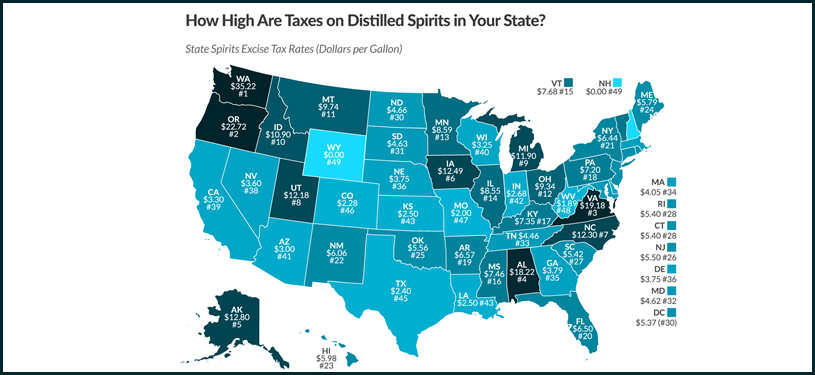

These States Have The Highest And Lowest Alcohol Taxes

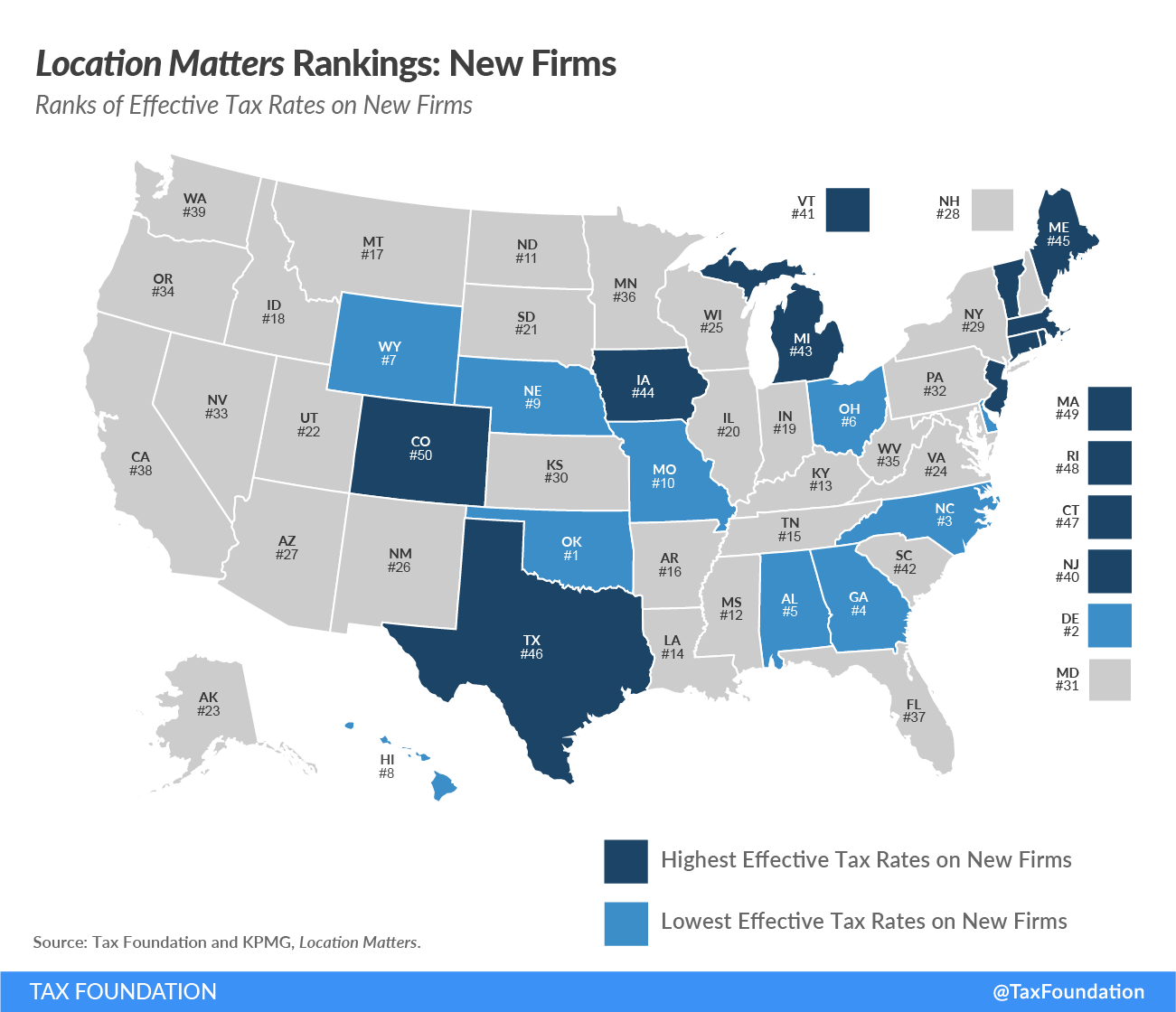

Missouri Tax Reform Missouri Tax Competitiveness

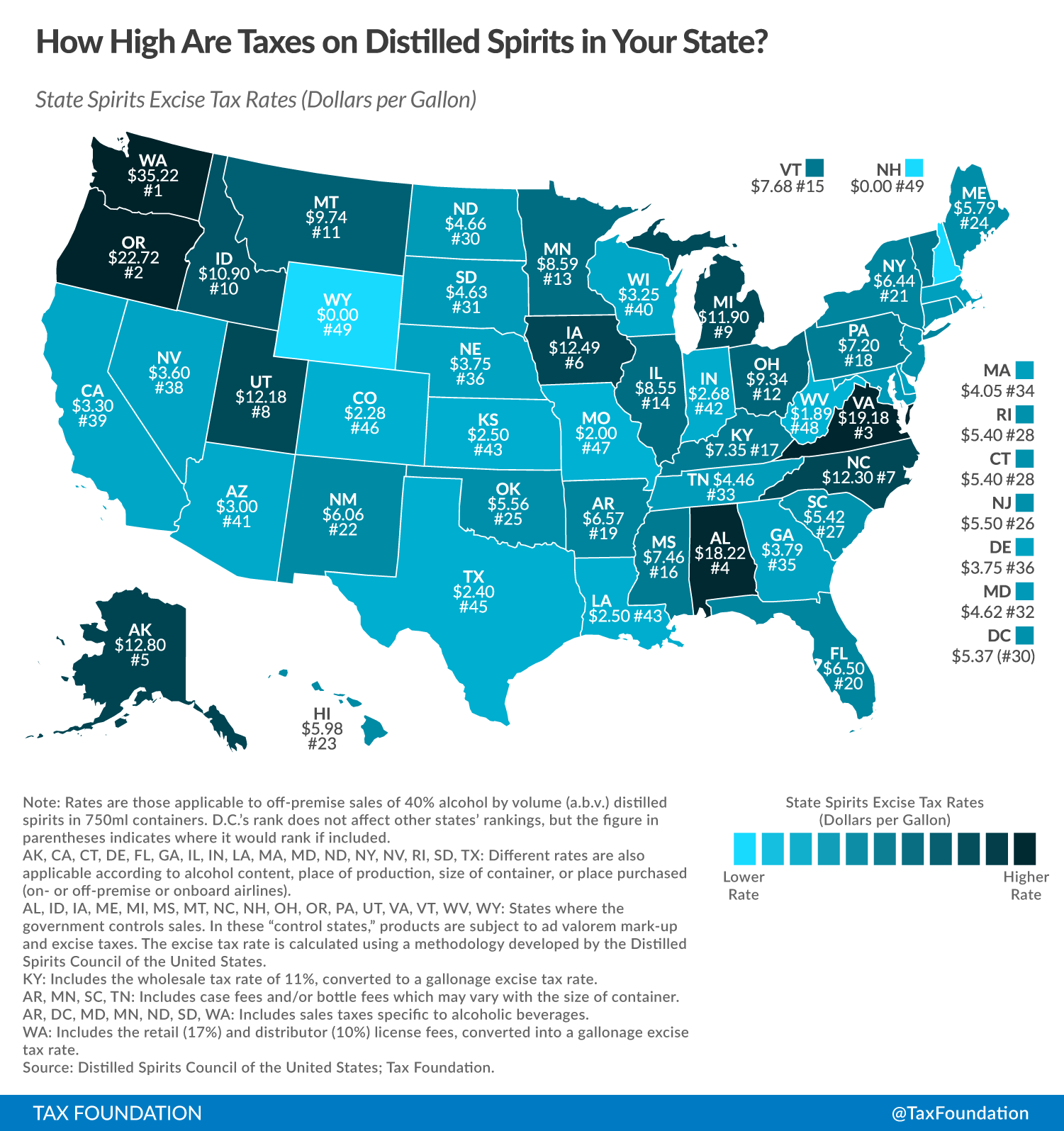

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

U S Alcohol Tax Revenue 2027 Statista

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Indiana Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Does Your State Have A Corporate Alternative Minimum Tax

Dor Indiana S Tax Dollars At Work

Indiana Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Criminalization Without Representation Learn Liberty Https Www Youtube Com Watch V Cgfphozayjilibertarian Party Of Indiana Learning Liberty Indiana

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

State Alcohol Excise Tax Rates Tax Policy Center

U S Alcohol Tax And Fet Reform Overproof

Criminalization Without Representation Learn Liberty Https Www Youtube Com Watch V Cgfphozayjilibertarian Party Of Indiana Learning Liberty Indiana